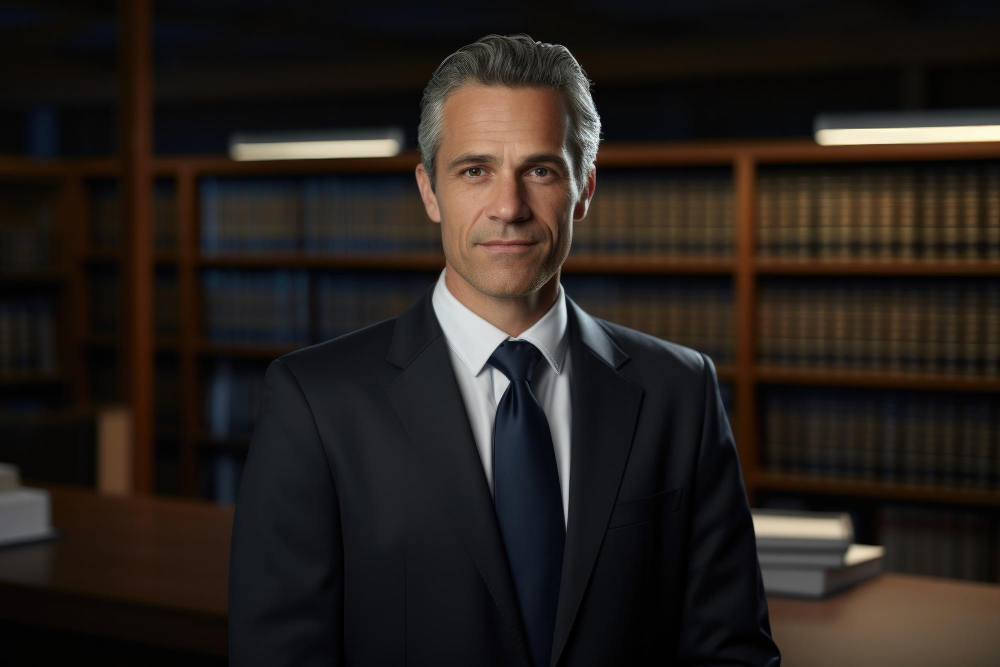

Our board of director training and certification program is well-suited to both board directors as well as senior management professionals, who would benefit from learning about risk management from a Board and risk oversight perspective. As a Qualified Risk Director, you will be skilled in managing the full complexity of your company’s risks and making strategic decisions with integrity and accountability. Besides, this program offers a strong foundation of risk management that will benefit the entire Board and its subcommittees, including the Board risk management committee.

The program also provides international best practice guidance on establishing an effective board risk management committee in your organization. Conducted by internationally experienced Board Directors and risk leaders, this program covers essential knowledge every board member needs to know in order to govern successfully.